From tftc

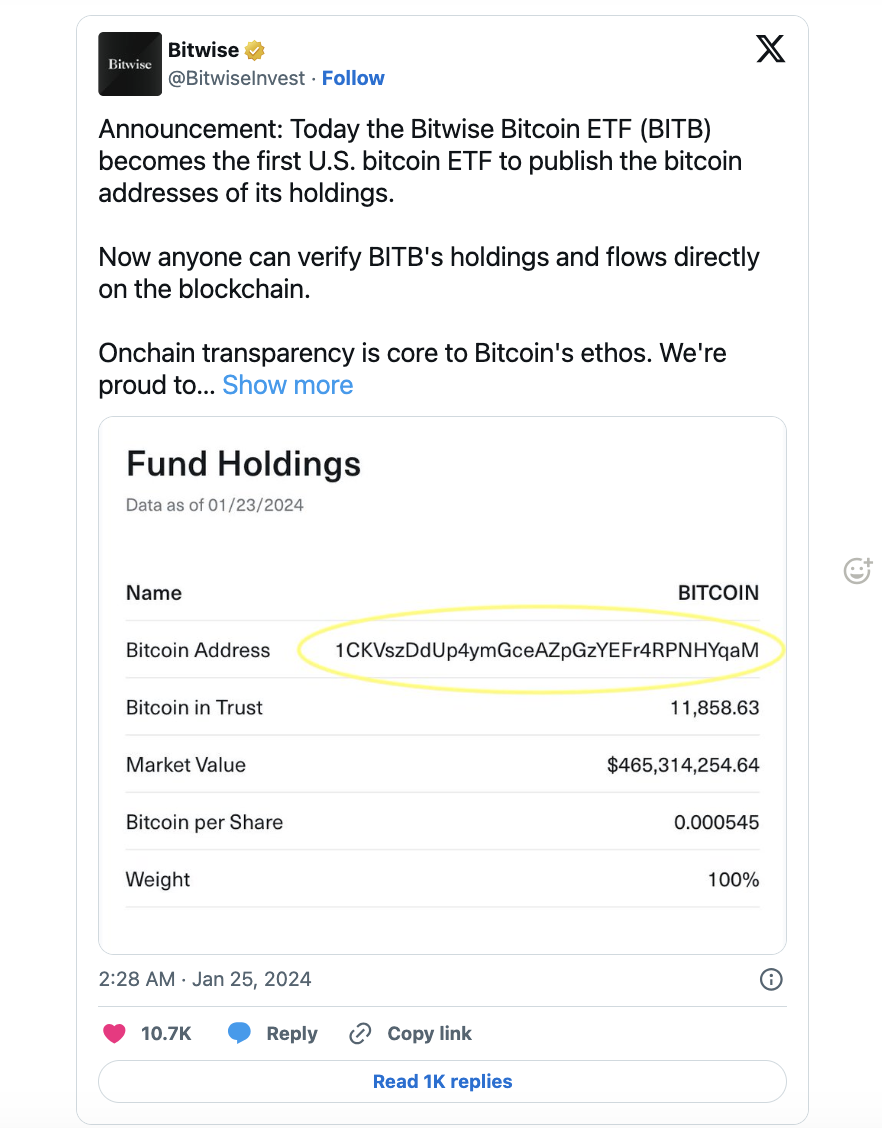

The Bitwise Bitcoin ETF (ticker: BITB) has recently marked a significant milestone in the cryptocurrency industry by becoming the first US Bitcoin ETF to publicly disclose the Bitcoin addresses holding its assets. This transparency move allows for verification of actual Bitcoin holdings, a critical factor in assessing the trustworthiness and security of such financial products.

Bitcoin ETFs and Asset Backing

A Bitcoin ETF is an exchange-traded fund that tracks the price of Bitcoin and allows investors to trade shares of the ETF on traditional stock exchanges. One of the concerns with Bitcoin ETFs has been whether they are backed by real BTC as collateral, or if they represent shares backed by "imaginary" BTC, drawing parallels to suspicions around gold ETFs.

The Bitwise Bitcoin ETF has demonstrated a robust approach to collateralization, as it appears to be holding more Bitcoin than required for the underlying shares. This makes it an over-collateralized ETF, arguably one of the safest based on collateral measures.

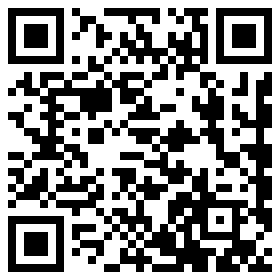

Public Address Disclosure

Bitwise has published the relevant Bitcoin addresses, which can be verified through blockchain explorers. As of the reporting, these addresses held approximately 12,338 Bitcoin, with a market value of around $510 million. The transparency of Bitcoin's blockchain allows anyone to view the transactions, including the meme-inspired amounts of 69 or 42069 satoshis (satoshis being the smallest Bitcoin unit).

Potential Risks

Despite the increased transparency, there are potential risks to consider. Public addresses expose the ETF to unsolicited transactions, which could include bitcoins from addresses sanctioned by the OFAC. Additionally, the use of a single signature address, as opposed to native Bitcoin multisig, may pose security concerns. Moreover, proof of reserves does not necessarily guarantee exclusive access or prevent the double pledging of collateral.

Bitcoin's Transparency vs. Privacy

The discussion around Bitwise's ETF also touches on the broader debate between transparency and privacy within the crypto ecosystem. Bitcoin's design favors transparency at the base layer, with privacy-enhancing tools available as additional layers or options. This transparency is contrasted with privacy-focused cryptocurrencies or account-based models like Ethereum, which inherently offer less transparency and auditability.

Towards Enhanced Verification

Bitwise has indicated that publishing on-chain addresses is just the beginning of their efforts to increase public transparency. Future plans include working with firms like Hoseki to provide real-time cryptographic attestations of reserves, further solidifying the trust in their ETF.

Comparison with Gold ETFs

The Bitwise Bitcoin ETF exemplifies the transparency advantage of Bitcoin over traditional assets like gold. Unlike gold ETFs, which rely on assumed safety and physical storage, a Bitcoin ETF can demonstrate actual holdings in real-time, showcasing the benefits of digital assets in terms of transparency and verifiability.

Conclusion and Recommendations

While direct ownership of Bitcoin is generally recommended for those seeking the full benefits of cryptocurrency, the Bitwise Bitcoin ETF represents a viable option for investors constrained to stock-like instruments. The ETF's commitment to transparency and its support for open-source Bitcoin development through profit donations to organizations like Brink, OpenSats, and the Human Rights Foundation, offer additional incentives to consider BITB as an investment vehicle.

Final Thoughts

The Bitwise Bitcoin ETF's public disclosure of Bitcoin addresses marks a significant step towards transparency in the cryptocurrency investment space. With its over-collateralized status and efforts to increase verifiability, BITB sets a new standard for Bitcoin ETFs, despite the inherent risks and challenges associated with the format. This development may serve as a model for future products and contribute to the broader acceptance and integration of cryptocurrencies within traditional financial systems.

All Comments